More than a million properties are at risk of flooding across 30 priority local government areas around Australia, new modelling shows.

And climate-change-fuelled riverine flooding could cause $170 billion in property value losses by 2050, or $45,000 per exposed property, research from risk analysis provider Climate Valuation found.

The highest-risk areas include Brisbane, the Gold Coast, greater Shepparton and Ballina where insurance coverage for thousands of homes is likely to be unavailable or unaffordable as early as 2030.

The warning comes as communities across south-east Queensland, northern NSW and Sydney clean up from floods that have left close to 5000 homes uninhabitable.

More than 47,000 homes in the Brisbane council area will be at high risk of flooding within eight years, with almost 50,000 more at moderate risk. Including those homes at high, moderate or low risk of flooding totals more than 211,000 homes – or 30.6 per cent of all properties in the council area.

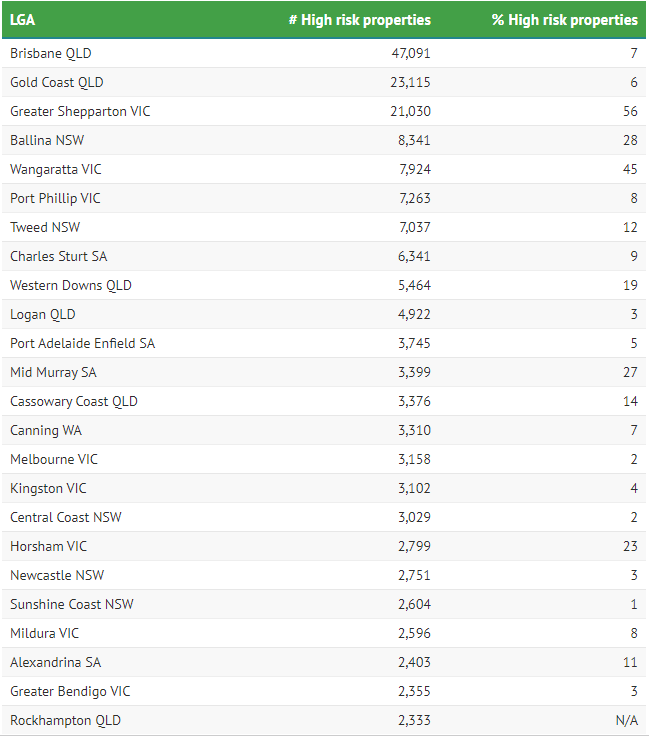

For the Gold Coast, about 140,000 properties face some flood risk, of which about 23,000 are high-risk, while Shepparton has about 21,000 homes at high risk, equating to 56 per cent of the area. Ballina has more than 8000 homes at high risk.

Local government areas with highest number of properties at risk from riverine flooding in 2030

Climate Valuation chief executive Karl Mallon said the risk could affect the value of the most exposed properties, a small but growing minority. Banks are required to check for climate change risk by the bank regulator, and could become hesitant to grant home loans to buyers in high-risk zones, he said.

“That’s why we think things will change relatively quickly mow, and we can expect some corrections in the property market,” Mr Mallon said.

He hoped banks would see the benefits of providing loans for flood mitigation renovations, which would make homes safer, more insurable, a better credit risk and more valuable.

“It would be great if banks saw the benefit of that and extended a loan to cover flood protection,” he said.

Homeowners can check local council flood maps to see their risk, which modellers calculate by looking at the topology of the landscape and survey data even for homes that are not next to rivers.

Mr Mallon encouraged people to check even for low flood risk, as some hard-hit homes in Lismore were considered low risk.

Even in a flood-prone area, some homes are more resilient than others, such as those with an upstairs living area and downstairs made from breeze block walls that will handle water better than a lower level made of a pine frame and plasterboard, he said.

Another solution is replacing a front fence with a brick wall and flood gate that may offer protection against one metre of water, or flood-proof doors and windows.

He called for government mitigation such as changes to building codes but said there are some communities where homes should be moved.

Risk Frontiers general manager Andrew Gissing said many places around the country could experience a natural disaster for the first time, whether flood, bushfire, cyclone or earthquake.

“Because of the growth of the population in that risk area, and also because we do have extreme events and obviously climate change will worsen those extremes into the future, we will have these extreme events which are bigger than what we’ve experienced,” he said.

But he said it was possible to foresee the potential impacts, adding that local government flood mapping had shown the properties flooded in Lismore were flood prone.

He said mitigation measures such as increasing the height of levees in the Lismore CBD

would reduce more frequent damage but not eliminate damage in extreme events, and backed a controversial plan to raise the wall of Warragamba Dam in Sydney.

For individuals, he highlighted flood-resilient building materials such as tiles, concrete and solid timbers instead of carpets or particleboard.

Mr Gissing said moving high-risk communities could be considered in consultation with the community but could add to housing stress by reducing the supply of homes in an area already dealing with a natural disaster.

Herron Todd White Melbourne managing director Tony Kelly said valuers provide advice to lenders that properties are in an area at risk of floods or fires, but banks make the decision about whether and how much to lend.

Valuers base their assessment of a property’s value on recent comparable sales, not on speculation about future environmental risks, he said.

“All we can do is report what they’re selling for today,” he said.

“If that risk of climate change and the rising sea level became serious enough in that community, then what we would see as valuers, we would see people paying less and less for properties … and we just have to watch and wait and see if that transpires or not.”

from Queensland Property Investor https://ift.tt/fNH6I1n

via IFTTT