2021 will go down as the biggest sales year the Gold Coast has seen for new apartments since the property consultancy Urbis began monitoring the sector

2021 will go down as the biggest sales year the Gold Coast has seen for new apartments since the property consultancy Urbis began monitoring the sector.

The number of apartment sales for the September quarter surged to 690, bringing the total of new apartments sold on the Gold Coast in the first nine months of this year to 1,882.

This figure has already eclipsed the previous full-year record of 1,556 sales in 2016.

There’s expected to be further figures which show the 2,000 mark was broken over the full calendar year, which has eyes looking toward 2022, and what’s in store for the Gold Coast apartment market.

There’s been a late push in to Christmas, later than any other year in living memory, to launch projects in to 2022.The Gold Coast is set to see a huge wave in early 2022 of some of the biggest apartment developments the suburb has ever seen.

We’ve had a look at some of the developments to watch out for.

La Pelago, Surfers Paradise

Developer: GurnerTM

Address: 108 Ferny Avenue, Surfers Paradise

The most anticipated development is no doubt the first foray in to the Gold Coast area by the Melbourne-based developer, GurnerTM.

Led by Tim Gurner, GurnerTM are set to launch La Pelago, the $1.25 billion, four-tower development which will bring over 1000 apartments to the Surfers Paradise dress circle Ferny Ave.

La Pelago, likely named after the small commune in Italy, centralises on a private island theme, where each building is surrounded by over 9,000 sqm of amenity, lush tropical landscaping by SWA and pool-side water retreats, creating four private islands.

Tim Gurner says La Pelago will be a new world experience for a beachside precinct that will be unlike anything ever attempted in Australia before, with an international hotel name that will be a new entrant to the Australian market.

Paradiso Place, Surfers Paradise

Developer: SPG Land and Gordon Corp

Address: 103 Ferny Avenue, Surfers Paradise

Just up the street and set to go head to head with Gurner is Paradiso Place, another mega-development site.

Paradiso Place 103 Ferny Avenue, Surfers Paradise QLD 4217

Recently launched, Paradiso Place will see 792 apartments constructed, with a $4 million sales gallery to boot. At 750 sqm, that alone is the largest display suite-style marketing touch point in the southern hemisphere.

The apartments, across three towers, will be part of an ever wider precinct, which will include almost 150,000 sqm of retail, amenities, and residential living.

SPG Land chairman David Wang says Paradiso Place will create a long-awaited destination precinct to fill the gaping void in the Surfers Paradise cityscape.

“Paradiso Place is strategically located between the Marriott Hotel, main beach and the traditional Surfers Paradise beachfront areas,” Wang says.

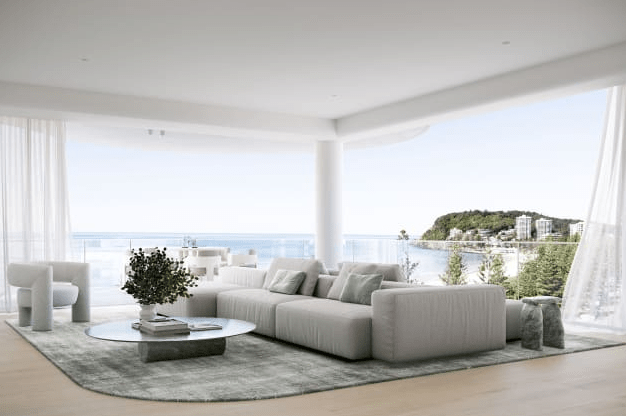

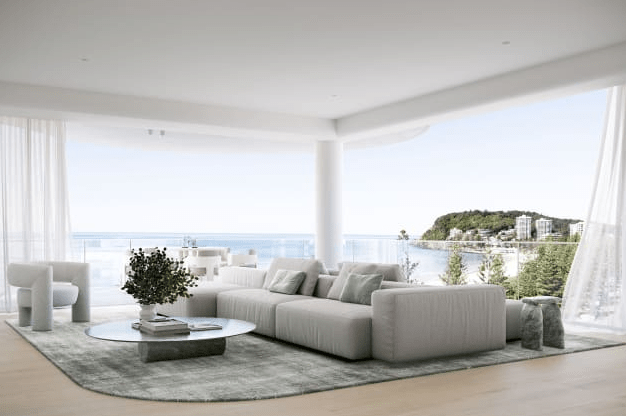

Yves, Mermaid Beach

Developer: Hirsch & Faigen

Address: 7-9 Mermaid Avenue, Mermaid Beach

2021 marked the entry to the Gold Coast apartment market for the Melbourne-based developer Hirsch & Faigen. They started with the 78 apartment project Hemingway at Palm Beach, which sold out in a matter of months, before heading to Kirra Beach for Emerson, something more boutique with 27 apartments starting from just shy of $3 million.

Their third project, just launched, is the three tower development Yves, in the sleepy Gold Coast village of Mermaid Beach.

Yves

7-9 Mermaid Avenue, Mermaid Beach QLD 4218

That will have 145 apartments across three towers, designed by Rothelowman, who handled the design of Hemingway and Emerson.

“We all know the Gold Coast has changed a lot in the last 60 years, and as more and more people escape the crowded ‘southern cities’, we anticipate she will change even more,” Rothelowman advised in their design statement.

“Between the sleepless Broadbeach & gentrified Burleigh, Mermaid Beach captures the diminishing modesty of the Gold Coast. It is a microcosm with cafes, craft and culture. A community of locals and tourists relishing a more humble urban lifestyle than the north & south.”

AURA, Surfers Paradise

Developer: ASF Group

Address: 59 Garfield Terrace, Surfers Paradise

In Q1 2022, the ASF Group are set to launch to the market AURA, a collection of just 26 full floor apartments, and one tri-level penthouse, across its 31 levels.

The tower, on the dress circle beachfront Garfield Terrace, will also feature an elevated lobby, gym and a club, activate all four sides defining a podium-like form through a dynamic raking column.

AURA follows ASF’s recent launch of The AU, an even more exclusive block of just 12 apartments.

One of the three-level penthouses in The AU just sold for $8.8 million.

The AU Surfers Paradise

52A The Esplanade, Surfers Paradise QLD 4217

Tapestry, Chevron Island

Developer: Siera Group

Address: 39 Darrambal Street, Surfers Paradise

Tapestry, the first Gold Coast apartment project for the Brisbane-based Siera Group, will be launching in early 2022.

Designed by BDA Architecture to pay homage to the Island’s new Home of the Arts precinct, Tapestry will have 83 apartments across its 17 levels.

Offering two and three-bedroom apartments, Tapestry will be crowned by an exclusive resident rooftop featuring a resort-style swimming pool with day beds, a spa, and a pool deck. A barbecue and alfresco area, will sit in landscaping, as will dining surrounded by an edible garden.

There’s set to be a private dining space with a terrace and fire pit, a gym with sauna and steam room, and a lounging area with a lawn.

Tapestry, Chevron Island

39 Darrambal Street, Surfers Paradise QLD 4217

Siera’s managing director Brett Thomson said he wanted to create something that was targeted at a wider net, rather than the multi million dollar apartments that are limited to the fortunate few.

“We want the local owner occupier, who could be living in a medium-size house in the area, to be able to downsize or rightsize, or have others who just want to find a new lifestyle, and have the opportunity to do so without being priced out.”

Lagoon, Main Beach

Developer: Drew Group

Address: 11 Cronin Avenue, Main Beach

The longstanding South East Queenslander developer, Drew Group, are set to create which will be the largest Main Beach devevelopment since the 1980s, set over a huge amalgamated 4,000 sqm site.

Plus Architecture designed the 248 apartments, which will be spread across two towers, linked by a central resort-style heated swimming pool and spa area.

Drew Group, led by Jonathan Drew since 2005, have history in the area and know it well, having previously created the 16-level, 29-apartment developer Cerulean on Pacific Street.

“As a local I feel an overwhelming responsibility to deliver an outstanding result for the Main Beach community and the future residents of Lagoon and this concept will be the central focus throughout the project until future residents move in,” Drew said.

Their most recent project The Village, some 72 apartments and beach houses at Palm Beach, was one of the fastest selling project in the Gold Coast over 2019 and 2020, securing all of the apartments in just three months.

Miles Residences, Kirra Beach

Developer: KTQ

Address: Corner of Miles St and Marine Parade

The second stage of the $380 million redevelopment of the Kirra Beach Hotel is set to launch in early 2022. The first stage only last a few months before it achieved a snappy sell-out, with the 50 per cent sold status coming in just a few weeks of launch this time last year.

Miles Residences Kirra Point | Penthouse

Corner Miles Street and Marine Paradise, Kirra QLD 4225

Residents will have access to the raised 25 metre swimming pool with gun-barrel, never to be built out views north across the beach. The Kirra Beach Hotel will be redeveloped as part of the project, with a new pavilion added.

No words as to how many apartments will be part of the next stage.

KTQ group have a very successful track record across residential and commercial projects in recent years. They have won a number of awards for Elements of Byron Bay, their exclusive and luxury northern NSW retreat. They also developed Bayshore Bungalows, also in Byron, which they also developed and own and operate.

KTQ are also set to release something special on their massive amalgamated Garfield Terrace beachfront site.

Sea, Burleigh Heads

Developer: FORME

Address: 96 The Esplanade, Burleigh Heads

The local developer FORME are again putting together something special which launched shortly before Christmas.

They’re selling Sea, their second Burleigh Heads development by the high-profile architecture firm Koichi Takada.

Sea

96 The Esplanade, Burleigh Heads QLD 4220

The boutique apartment building of just 27 apartments follows the rhythms and designs as their sold-out Goodwin Terrace projects Norfolk and Luna.

Demand was so high for Norfolk, which recently settled as one of the Gold Coast’s most expensiave apartment developments, that Forme boss David Calvisi put together the same team for Sea, with the aim to create a similar-style project slightly further south on The Esplanade.

Also featuring interiors from the Melbourne-based Mim Design, Sea comprises half-floor apartments, each with three bedrooms and 240 sqm of living space. The full-floor apartments of around 480 sqm are configured to include three ensuited bedrooms, a multi-purpose room, media lounge, home gym, walk-in wine display bar, and a lifestyle space with a fireplace and butler’s pantry.

Residents are afforded exclusive access to an array of in-house amenities including a pool, sauna, ice baths, gymnasium and pilates studio, and an alfresco dining terrace serviced by an integrated barbecue kitchen ensconced by idyllic gardens.

Palais Coolangatta

Developer: BeckDev

Address: 31-35 McLean Street, Coolangatta

Another Q1 release will see Palais Coolangatta, the $130 million apartment development on the site of the landmark Jazzland Dance Palais that has stood on the 2,355 sqm site since the 1930s, hit the market.

Developed by the Melbourne-based BeckDev, Palais Coolangatta will have 175 one, two and three-bedroom apartments, as well as resident facilities and a street-level plaza with retail space.

BDA Architecture has designed the plans for the development.

Ben Beck, director of BeckDev and son of the industry veteran Max Beck, said Coolangatta stood out as one of the Gold Coast’s gems.

“Its riches lie in its natural amenity, world class surfing beaches and deep sense of community,” Beck said.

Eden Avenue, Coolangatta

Developer: Kingbella Group, Steer Developments, CAPDEV Partners

Address: 44 Eden Avenue, Coolangatta

A joint venture trio of Kingbella Group, Steer Developments, and CAPDEV Partners, are teaming up for a 12-level Coolangatta project.

The project, designed by Plus A rchitecture, who describe the tower as “beachside luxe living”, will home 91 apartments and three townhouses.

It will sit across four amalgamated lots totalling 1,924 sqm between 44 and 50 Eden Avenue.

The development will be crowned by a rooftop amenity level featuring an infinity edge pool, sun beds, adjoining spa, a wet deck, garden day beds and barbecue booths.

Belvue, Runaway Bay,

Developer: Polites Property Group

Address: 13-15 Bayview Street, Runaway Bay

Runaway Bay is set to see its first residential tower to be developed in the idyllic Gold Coast waterfront enclave for almost three decades.

Belvue, French word for beautiful view, is set to be developed in a joint venture between Monaco Property Group and Polites Property Group, who has just lodged a development for the project.

The luxury tower on a 3,116 sqm site at 13-15 Bayview Street, has been designed for the owner-occupier, with just whole floor apartments.

The 31 apartments, which have four bedrooms each (or three and a multi-purpose room), will each take up a level of the 31 storey building, which is reminiscent of a resort-style hotel, without the mass number of rooms.

Plus Architecture, who are handling the design, call Belvue “the sophisticated newcomer to Runaway Bay.”

Myst, Broadbeach

Developer: Orenda Projects

Address: 14 First Avenue, Broadbeach

The owner-occupier focused residential tower Myst, in the heart of Broadbeach, is set for an early 2022 launch.

Myst

14 First Avenue, Broadbeach QLD 4218

The Plus Architecture-designed plans for 14 First Avenue will have 46 apartments across the 33-level tower, 45 of those being three-bedroom apartments, which, apart from the three whole-floor sub-penthouses, will span half of a floor.

The top two levels will be dedicated to a two-level penthouse, the only four-bedroom apartment in the building. That will have its own private terrace with a swimming pool.

Article Source: www.urban.com.au

from Queensland Property Investor https://ift.tt/3u0R4jB

via

IFTTT