Six interest rate rises in and the pressure on sellers to drop their price expectations is taking its toll, with new data revealing Brisbane, Darwin, Perth, Melbourne and Sydney home owners are discounting their asking prices at rates not seen since 2019.

Sydney is feeling it the most. The average reduction in the asking price of a Sydney house is now at 7.8 per cent – higher than any other capital city – and has been rising steadily since May, according to data from Domain.

A discount of 7.8 per cent on the city’s median house price of $1,552,015 would equate to $121,057 off the asking price.

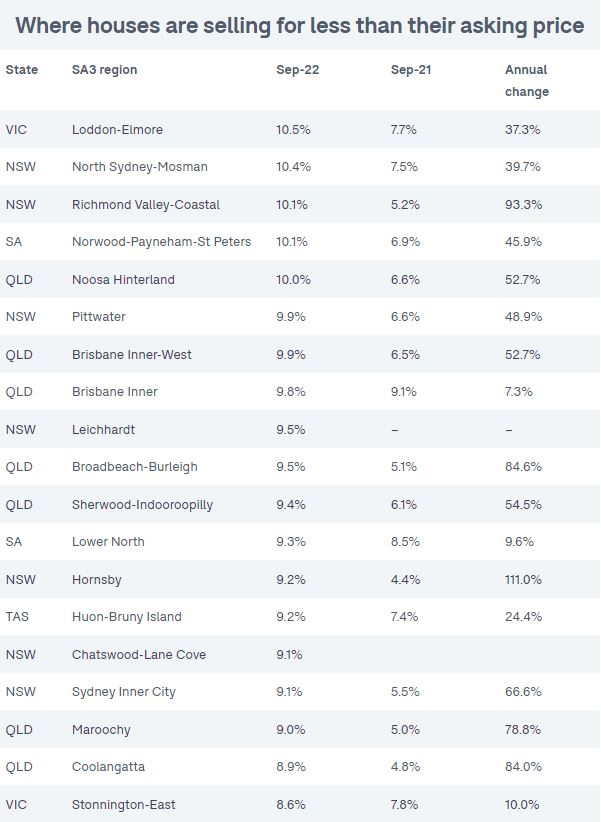

Sellers are also dropping their prices in Brisbane, with the highest spikes in discounting occurring in areas like the Inner City and Sherwood-Indooroopilly, while in Melbourne, it’s buyers in Stonnington East that are most likely to get a discount.

A 9.4 per cent discount off Indooroopilly’s median house price of $1.4 million is equivalent to $131,600.

North Sydney-Mosman, Pittwater and Leichhardt are seeing some of the highest discounts on asking prices in Sydney.

In Adelaide, house prices are being slashed by more than 10 per cent in the Norwood-Payneham-St Peters region.

But the price reductions are not limited to the capital cities. Sellers in regional areas are meeting the market too.

The region with the highest rate of discounting in the nation over September was the Loddon-Elmore area just north of Bendigo in Victoria, where the average discount has hit 10.5 per cent.

Even Byron Bay, one of the pandemic property boom’s biggest success stories, is feeling the pressure.

The Richmond Valley-Coastal region, which captures Byron Bay as well as surrounding regions like Lennox Head, Suffolk Park, Lennox Head and down to Ballina, has seen the average discount on asking prices skyrocket by 93.3 per in the 12 months to September.

The average discount in that region on a house price is now 10.1 per cent. A discount off Byron Bay’s median house price of $2.525 million would equate to $252,500 off the price.

“There’s always a level of discounting in the market, no matter the conditions, but it’s the direction of where the discounting is going that gives us an idea of the health of the market. If discounting is rising, we’re selling homes for lower than the asking price,” says Nicola Powell, chief of research and economics at Domain.

Powell says buyers have made a complete 180 from last year when the market conditions were so competitive it was commonplace to offer well above an asking price.

“What we’ve got now is buyers factoring in that their borrowing power has been reduced, and also, because we’re further along into that downturn, they’ve got a deeper understanding of where the market is at,” she says.

“Buyers might be a little more comfortable placing that offer below the market price than they might have been earlier in the cycle. Now, they know they’ve got more sway and are probably feeling more confident to put in that cheeky offer.”

There is early evidence that discounting is slowing down, rather than speeding up, in some capital cities.

Domain’s data showed that while the average discount on asking prices has been steadily increasing across the board in every capital city this year, Hobart, Canberra and Adelaide all saw the rate of discounting fall over September.

Powell says buyers and sellers both now have a better understanding of the property market and how much it’s changed this year.

“I’d say discounting has increased not just because buyers are offering less but because sellers have become even more open. They think, ‘this is the only offer I’m going to get’.”

Discounted asking prices are music to the ears of every house hunter who has seen their borrowing power steadily eroded with every one of the monthly interest rate rises since April.

But even reductions of up to 10 per cent off a property’s asking price are not enough to offset the difference the interest rate rises have made to a buyer’s borrowing power and consequent purchase budget, Powell says, which run into the hundreds of thousands of dollars.

“This will definitely be impacting what buyers can do and what they can pay,” Powell says. “The difference now in October is that buyers are feeling confident enough that they have the upper hand and can ask for that discount on the asking price.”

Article source: www.domain.com.au

from Queensland Property Investor https://ift.tt/n3EFJYG

via IFTTT