The Coalition will raise the price caps for houses eligible under its controversial Home Guarantee Scheme to help home buyers get into the property market faster as the soaring cost of housing plays a key role in the federal election.

Buyers with a deposit as low as five per cent can apply to the scheme, in which the government guarantees up to 15 per cent of the mortgage so buyers don’t need costly lenders’ mortgage insurance.

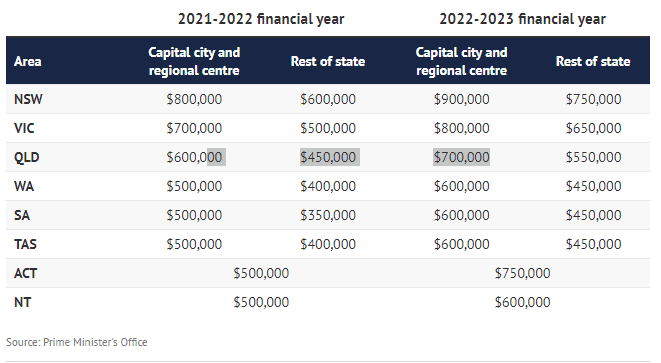

Prime Minister Scott Morrison said on Sunday night the price caps on the popular scheme had been raised to $800,000 for Melbourne and regional Victoria and $900,000 in Sydney and regional NSW.

“We’re building a stronger future for Australians by making home ownership easier by making more properties eligible for the scheme,” Morrison said.

The number of places in the scheme was doubled to 50,000 a year in the federal budget in March at a cost of $8.6 million, prompting economists to warn it would drive up the cost of housing.

Economists also cautioned buyers who could only save a five per cent deposit not to extend their finances ahead of rate rises forecast in the second half of this year.

Home Guarantee Scheme

The scheme was initially capped at $700,000 for houses in Melbourne and Victorian regional centres, and $800,000 in Sydney and NSW regional centres. The capital city price cap applies to regional centres with a population over 250,000. A lower price cap applies to the rest of each state.

Analysis by CoreLogic showed under the old price cap of $800,000 only 14.6 per cent of suburbs in greater Sydney would have been eligible in 2021/22. In Melbourne, with the old limit of $700,000, just 20 per cent of locations would have been eligible.

Independent economist Saul Eslake said in March the scheme would result in “more expensive housing”.

“For all the crocodile tears politicians shed for aspiring first-home buyers … the reality is there aren’t many of them compared with the vastly greater number … who own one property [and] who benefit from rising property prices.”

Homeowners will also face increased repayments after the federal election, the Reserve Bank board signalling it could raise the cash rate as soon as June.

“Higher interest rates are coming: the only question is just how big the rate rises are and how quickly they occur,” Grattan Institute economist Brendan Coates said earlier this month. “People should prepare for that and be ready for the fact that it’s probably going to come quickly.”

The 50,000 annual places available under the Home Guarantee Scheme include 5000 guarantees for single-parent families, who can apply with a deposit of only 2 per cent.

There are also 10,000 guarantees a year for buyers, including non-first home buyers and permanent residents, to purchase or construct a new home in regional areas.

“We acknowledge how hard it can be to buy a new home or re-enter the housing market and that saving a deposit is the hardest part of getting into home ownership,” said Housing Minister Michael Sukkar.

“By adjusting the price caps for the Home Guarantee Scheme, we are ensuring Australians have more options when buying a home.”

Article Source: www.brisbanetimes.com.au

from Queensland Property Investor https://ift.tt/nCYzfV3

via IFTTT