The big four banks are predicting house prices will drop by up to -14 per cent in the next two years, an outcome that would wipe out a sizeable chunk out of the massive gains seen over the past 15 months.

Some real estate experts disagree, though, suggesting that the outlook may not be so dire.

So what does it all mean for potential sellers who are wondering how to navigate what may be a turbulent market ahead?

The banks are forecasting a substantial drop in house prices

Even before the conflict in Ukraine sent global markets into a spiral of uncertainty, economists at Australia’s big four banks were outlining a treacherous path for the country’s property price growth.

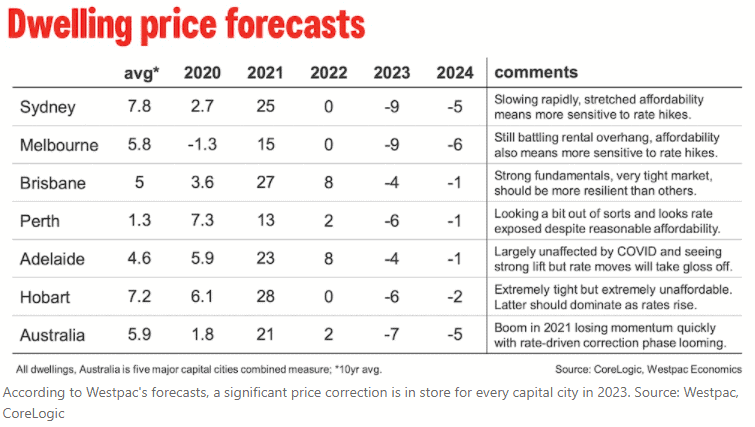

With interest rates tipped to rise later this year and housing affordability worsening, Westpac announced their forecasting for 2023 and 2024.

The bank expects an overall fall in house prices of -14 per cent from the market peak, with values beginning to dip in the second half of 2022.

“Australia’s housing market boom is showing clearer signs of slowing with sentiment pointing to a decline in turnover through the first half of 2022,” Westpac Senior Economist Matthew Hassan explained.

“More importantly, the medium-term outlook has shifted materially with an interest rate tightening cycle now expected to see a broad-based correction phase begin later this year, continuing throughout 2023 and into 2024.”

The other banks have taken a less dramatic approach, though all four are aligned on the expectation that prices will fall in 2023.

The forecasts for next year are a -10 per cent drop for NAB and CBA, with ANZ predicting a fall of -6 per cent.

If Westpac’s predictions were to hold true, the value of the median Sydney home would fall by over $150,000 from today’s prices—a major downshift for sellers.

Other experts are seeing a different outcome

Not everybody in the industry sees things playing out the way that the banks do.

Michael Yardney, director of Metropol Property Strategists and the name behind the popular Property Update blog, urged caution around the pessimistic messaging that’s out there.

He noted that predictions of a -20 per cent market crash are nothing new, “but just look at the terrible track records—they’ve been predicting this every year for the last decade and they’ve been wrong.”

As he put it, “our property markets are just going to move out of the sixth gear into third or fourth gear—they are not going into reverse.”

For the remainder of 2022, Mr Yardney expects buyer demand will remain strong, investors will be “back with a vengeance,” and property prices will continue to rise—just at a slower rate than we saw last year.

Housing economist Andrew Wilson shares that sentiment. Looking at the banks’ predictions for next year, he told The New Daily that “these are quite remarkable forecasts.”

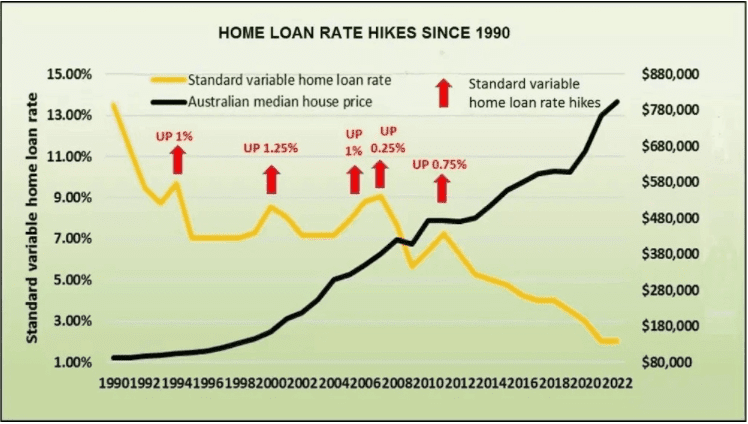

“Historically we’ve only had three years of falling prices since 1987,” he pointed out.

Generally speaking, Dr Wilson believes that the market response to rising interest rates won’t be as rapid or severe as the banks are forecasting, so any price falls would likely be more moderate.

What does the future hold for Australian property?

With so much conflicting information and opinion out there, it can be difficult to understand how to approach the coming 12 to 24 months.

On the one hand, it does look highly likely that interest rates will begin to rise later in 2022, and the banks—Westpac especially—say that’s going to spark a significant reversal in growth.

The other perspective looks to historical data and suggests that the future won’t be as gloomy for homeowners as the banks are making it out to be.

One thing does seem certain, which is that the booming prices seen throughout 2021 are now in the past, and any future growth will be far more restrained.

Nobody has a crystal ball, but one of the best ways to understand the conditions in your market and whether or not growth has peaked is to speak to a top local agent.

Ultimately, they’re the ones who know how properties in your particular suburb are selling, what buyers are thinking, and which way things could shift.

For now, with property prices still at all-time highs across the country, conditions are still very much favourable to sellers.

Article Source: www.openagent.com.au

from Queensland Property Investor https://ift.tt/jUhE8ar

via IFTTT