Investor lending for housing has hit a six-year high, helping firm predictions the “up-crash” in the sector will continue.

New loan value commitments for investor housing rose 13.3 per cent month-on-month, a 116 per cent increase since May last year, which was the lowest since November, 2002, according to Lending to Households and Businesses data for May from the Australian Bureau of Statistics.

UBS economist George Tharenou has forecast a 15 per cent year-on-year growth in house prices and ongoing low rates will cause the up-crash to continue.

Tharenou said record-high home loans meant housing credit would continue to accelerate in coming months to a forecast 7 per cent year-on-year.

Owner-occupier loan commitments rose 1.9 per cent to reach another all-time high according to the ABS.

ANZ economist Adelaide Timbrell said investor lending was at its strongest since June 2015, and the seventh strongest month for investor lending since records began in 2002.

“Falling vacancy rates and improvements in the labour market, which generally leads to more demand for rental property, are both promising signs for investors,” Timbrell said.

“Sydney’s vacancy rate is back to its pre-pandemic rate and Melbourne is continuing to absorb some of its pandemic-related vacancies.

“The monthly value of owner occupier lending hit another record high, with 1.9 per cent month-on-month growth in May … 58 per cent above the average for 2015–19.”

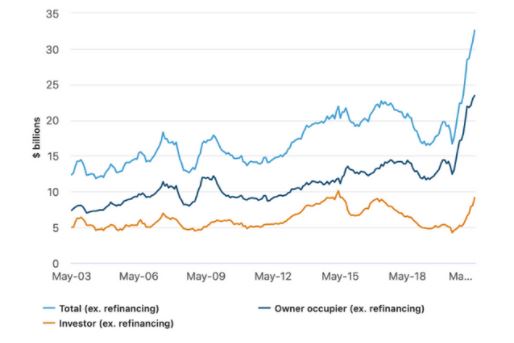

New loan commitments (total housing)

Domain data showed vacancy rates had dropped to 1.6 per cent nationally, the third consecutive monthly fall.

Domain senior research analyst Nicola Powell said Melbourne had accounted for a large portion of the monthly drop in the national vacancy rate as it continued its rental recovery from the Covid-19-induced bounce.

HIA economist Angela Lillicrap said the strength of the broader housing sector had drawn investors back into the market, but there had been a dip in loans for construction.

“The number of loans for the construction of a new dwelling continued to fall in May, but remain elevated compared to pre-Covid-19 levels,” Lillicrap said.

“Low interest rates and strong house price growth will continue to support demand for housing over the coming months.”

Lillicrap said loans for established homes had increased 10.3 per cent in the three months to May, the third-highest on record.

She said the first home buyer activity remained elevated, up by 63.7 per cent in the three months to May, when compared to the same time last year.

Article Source: www.theurbandeveloper.com

from Queensland Property Investor https://ift.tt/3yimjFy

via IFTTT