The reserve bank has continued to hold interest rates at a record low of 0.1% as house prices across Australia keep rising.

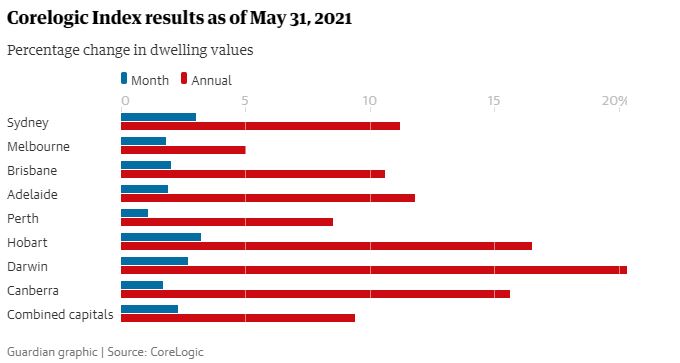

The national housing market rose 2.2% in May, according to the latest data from CoreLogic, following on from a 1.8% rise in April and a 32-year record rise in March of 2.8%.

In Sydney prices rose 3% in May alone, and prices are now up 9.5% in only the past three months (March-May).

They rose 8.5% in the first three months of 2021 – the largest quarterly rise since records began. The median house price in Sydney is now $970,355.

Prices have reached record highs even though borders have been closed for more than a year and immigration halted, with the boom fuelled largely by Australian buyers with improved savings and low interest rates.

Tim Lawless, the research director of CoreLogic, said housing values were up “across every capital city over the month, with both house and unit values lifting across the board”.

He said soaring prices were due to “the combination of improving economic conditions and low interest rates”.

“At the same time, advertised supply remains well below average,” he said. “This imbalance between demand and supply is continuing to create urgency amongst buyers, contributing to the upwards pressure on housing prices.”

According to CoreLogic, the number of homes listed for sale nationally is 24% below the five-year average.

And even as supply picks up, continuing high demand means that sales still exceed supply.

“The sales-to-new listings ratio remains around 1.1, meaning for every new listing there is more than one sale occurring,” Lawless said. “This rapid rate of absorption is keeping advertised inventory levels extremely low, despite the rise in new listings. As a consequence, vendors remain in a strong selling position while buyers have a weak position at the negotiation table.”

Prices rose 3.2% in Hobart over the past month, 3% in Sydney, 2.7% in Darwin, 2% in Brisbane, 1.9% in Adelaide, 1.8% in Melbourne and 1.7% in Canberra,

The combined capital city prices rose 2.3%. Prices in combined regional areas rose 2%. Out of 334 subregions analysed by Corelogic, 97% recorded a house price rise.

“Such a synchronised upswing is an absolute rarity across Australia’s diverse array of housing markets,” Lawless said.

The CoreLogic report also found that “worsening affordability pressures are likely to impact first homebuyers more than other segments of the market” and “there are already signs that first homebuyer demand is pulling back”.

“Investors, on the other hand, are stepping up their activity across the housing market, motivated by prospects for continued capital gain and low interest rates,” CoreLogic said.

Over the past year, house prices have risen 20% in Canberra, 16.3% in Adelaide, 15.1% in Brisbane, 11.2% in Sydney, and 5% in Melbourne.

… we have a small favour to ask. Millions are turning to the Guardian for open, independent, quality news every day, and readers in 180 countries around the world now support us financially.

We believe everyone deserves access to information that’s grounded in science and truth, and analysis rooted in authority and integrity. That’s why we made a different choice: to keep our reporting open for all readers, regardless of where they live or what they can afford to pay. This means more people can be better informed, united, and inspired to take meaningful action.

In these perilous times, a truth-seeking global news organisation like the Guardian is essential. We have no shareholders or billionaire owner, meaning our journalism is free from commercial and political influence – this makes us different. When it’s never been more important, our independence allows us to fearlessly investigate, challenge and expose those in power.

Article Source: www.theguardian.com

from Queensland Property Investor https://ift.tt/3yXF95Y

via IFTTT