A sobering report by real estate professionals has said property prices are “increasingly unaffordable” and Australians may never own a home.

First time home buyers are all too aware buying their first pad right now is a struggle.

Now that’s been confirmed by the industry itself with real estate professionals darkly warning large numbers of “average” Australians “may never be able to enter the property market” given the inexorable rise in prices.

That sobering residential reality comes as it was confirmed Sydney house prices had soared. The average house is in the Harbour City is now going for $1.1 million with units at $800,000.

A typical Sydney house is now about $117,000 pricier than it was at the end of February. Industry organisation the Australian Property Institute (API) and tech firm The Search People surveyed almost 600 property valuers across Australia to gauge their attitudes to the property market.

Property valuers conduct detailed inspections of homes, looking at the number of rooms and size as well as a property’s condition to ensure it’s fit to be bought or sold, is priced correctly and if any improvements need to be made to make it market ready.

Almost half think property ‘unaffordable’ for average Australian

The report found 59 per cent of valuers believed the Australian housing market was currently in a bubble. While 55 per cent thought most homebuyers were over capitalising on their purchase.

Most damningly, 43 per cent of valuers said property was now essentially out of reach for the “average” Australian.

“The likelihood of owning a home is becoming increasingly low as residential property becomes unaffordable for the average Australian,” the firms stated.

“Aussies may never be able to enter property market.

Almost half of property valuers believe property is unaffordable for the average Australian. Picture: Australian Property Institute/The Search People.Source:Supplied

“Professional valuers believe Australia’s residential real estate prices will continue to rise despite serious affordability and sustainability concerns,” the report added.

There may be a bubble, but in the short term at least that bubble doesn’t seem set to burst, said The Search People’s Rafe Berding.

“Most respondents believe a boom is set for the Australian property sector, however the majority also believe Australia is currently witnessing the makings of a property bubble.

“A combination of record low interest rates and buyers’ uncertainty of investing in other alternatives is fuelling high demand. This coupled with low supply is driving a ‘fear of missing out’ for many buyers.

“As a result, in some cases, properties are being snapped up significantly above the asking price within moments of being listed,” he said.

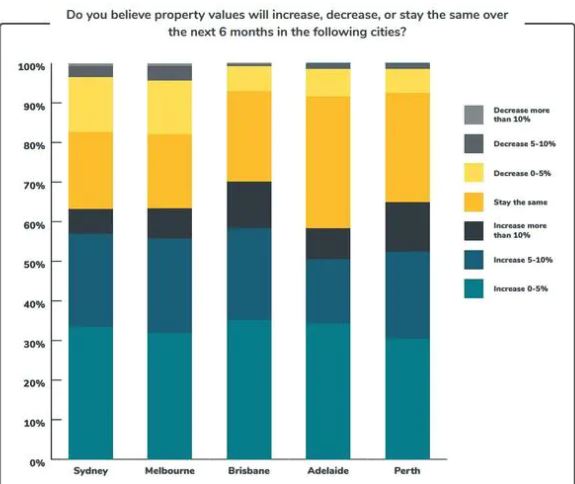

Property values are predicted to surge, particularly in Brisbane. Picture: Australian Property Institute/The Search People.Source:Supplied

Sydney, Melbourne, Perth seeing the strongest growth

Almost two-thirds said they saw “continued strong growth” for property values across Australia’s six main capitals in the next six months.

The report said this was a “worrying” trend that would disadvantage many prospective buyers.

More than 60 per cent of those surveyed in Sydney, Melbourne and Perth said they expected prices to rise. In Brisbane, it was even starker with 70 per cent believing a price jump would occur with around 12 per cent of those saying prices in the Queensland capital could go up by more than 10 per cent.

Adelaide is the most affordable capital, but even here more than 55 per cent of valuers have said the only way is up for house prices.

API chief executive Amelia Hodge said the market was firing on all cylinders.

“With record low interest rates, we’re seeing more and more buyers entering the market.

“This is great news for Australians selling property, especially with values on the rise in most sectors and selling times decreasing across most capital cities.”

More than half of those surveyed said Australians should be allowed to access their super to pay for property.

Sydney average house price now $1.1m

Data from property research firm CoreLogic, released on Tuesday, showed prices for all categories of housing rose 3 per cent for the month – one of the largest monthly rises on record.

The median price of a Sydney house is now $1.186 million, while the median unit price is $782,000, according to the data firm.

CoreLogic head of research Tim Lawless said the median house price would likely hit the $1.2 million mark soon – even as early as next month. “It wouldn’t take much growth, it’s nearly there,” he said.

May’s bump in prices was a modest slowdown from March, when values climbed at the fastest pace in 32 years, but the growth still dwarfed price rises across the rest of the country.

Sydney’s price rise was 66 per cent higher than in Melbourne and about 36 per cent higher than the national average.

Mr Lawless said he expected rises to moderate over the coming months as buyers became priced out of the market.

“It will reach a point where fewer buyers can compete,” he said.

Housing supply was also beginning to increase in many suburbs and a further increase would take pressure off of buyers to bid up prices.

A shortage of listings had been one of the biggest drivers of the recent price boom, Mr Lawless said.

Backing up the API report that Perth is set to for a big rise in prices was an analysis by comparison website Finder.

In Perth, property prices were predicted to rise by 8 per cent over the next seven months, adding almost $80,000 to the value of properties, giving them an average value of $609,000.

Australian Bureau of Statistics data from April showed the average deposit needed to secure a mortgage was $106,743 – an increase of 16 per cent since January 2019.

The ACT had the largest home deposit increase since 2019, with the upfront amount required swelling by 24 per cent to $117,790, followed by NSW – up by 23 per cent to $128,469.

Article Source: www.news.com.au

from Queensland Property Investor https://ift.tt/3fKDaue

via IFTTT