Are you wondering what will happen to the Brisbane property market this year?

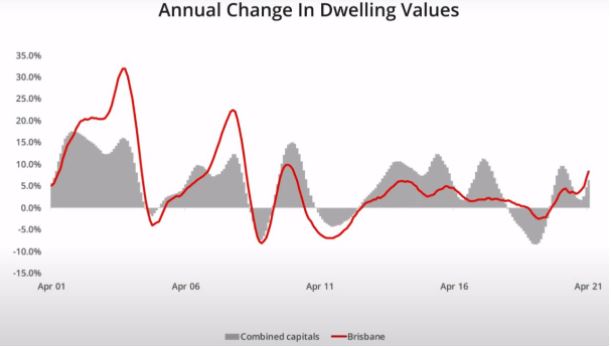

Well…Brisbane house prices remained resilient last year when other parts of Australia suffered from the economic impact of the GVC (Global Virus Crisis) but they are now roaring ahead in 2021.

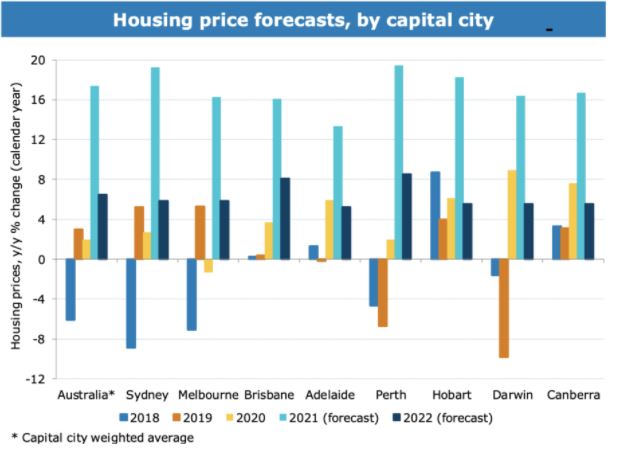

A recent report released from ANZ Bank forecasts Brisbane house prices will rise by a strong 16% through 2021, before slowing to 8% property price growth in 2022.

What a turn around from all the pessimistic forecasts all the banks made in the middle of last year.

ANZ senior economist Felicity Emmett expects the Australian Prudential Regulation Authority (APRA) will introduce macro prudential measures to slow house price growth into 2022.

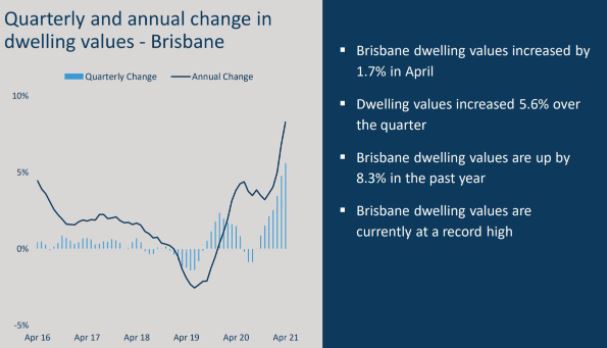

Currently the Sunshine State is shining and has delivered 5.6% growth in the last 3 months and housing prices are up by 8.3% in the past year.

Outstanding demand for lifestyle areas as well as extremely strong demand for detached houses in Brisbane, particularly in the inner and middle ring suburbs has delivered 5.3% overall growth in the last 3 month, with Brisbane’s more expensive properties outperforming.

The resurgence of buyer interest in the Brisbane property market has meant that auction clearance rates have consistently been in the 70% range, which is unusual for Brisbane considering this city is not known for its auction culture like it’s southern cousins, but this is just another suggestion that there are more buyers than there are sellers and this always leads to higher property prices.

At Metropole’s Brisbane office we are noticing more investors are getting into the Brisbane market recognising that while there are no bargains to be found, in 12 months time the properties they purchased today will look like a bargain.

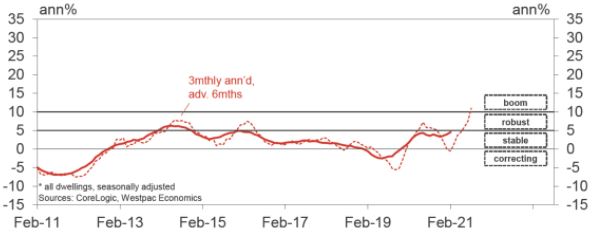

Not that long ago Westpac Bank updated its forecasts and tipped Brisbane prices to surge 20 percent between 2022 and 2023, meaning Brisbane is likely to be one of the best performing property markets over the next few years.

Of course, while some locations in Brisbane have strong growth potential, and the right properties in these locations will make great long-term investments, certain submarkets should be avoided like the plague.

Increased demand for Brisbane houses has been underpinned by increasing consumer sentiment, historically low-interest rates, and internal migration considering the relative affordability of houses in Queensland compared to Sydney and Melbourne.

Similarly, popular areas of the Gold Coast and Sunshine Coast have enjoyed strong demand considering the increased flexibility of being able to work from home and commuting to the big smoke less frequently.

At the same time, property investor activity has been strong, particularly for houses, not only coming from locals but from interstate investors who see strong upside in Brisbane property prices as well as favourable rental returns.

But be careful…there is not one Queensland property market, nor one south-east Queensland property market, and different locations are performing differently and are likely to continue to do so.

Houses remain a firm favourite of prospective home hunters, with demand rising post-lockdown and it remains significantly elevated compared to last year.

However, apartment demand has been sliding and, in general, apartments in Queensland are a higher risk investment than houses, particularly due to a high supply of apartments that are unsuitable for families or owner-occupiers.

To help you make an informed investment decision, I’m going to examine what’s going on in the Sunshine State in detail in this article.

But be warned…it’s a little longer than normal, so if you’re looking for a particular element of the Brisbane property market, use these links to skip down the page.

There are multiple markets in the diverse sprawling city of Brisbane; divided by geographic location, price point, and property type.

And just to make things clear…I’m talking about the property market in Brisbane – not the Queensland property market.

That’s a very different animal!

If you’ve been following my property investment strategy, you’ll know I only invest in capital cities and that’s why I avoid the Sunshine Coast, the Gold Coast, and Queensland’s regional markets which have very different (and fewer) growth drivers than Brisbane and are therefore more volatile.

And not all Brisbane properties will perform well.

In Queensland houses are the preferred style of accommodation over units and investors who buy rental apartments in high supply areas are taking high risk with both equity and cash flow risks materially increasing over buying the right house.

So…is it the right time to get into the Brisbane property market?

Anyone who buys an A grade home or investment grade property in Brisbane now will look back in a couple of years time and recognise they bought a bargain, as this new property cycle still has some years to run.

There is a perfect storm of positive growth drivers that will have Brisbane house prices performing strongly in 2021 and 2022.

- The biggest game-changer has been how quickly our economy recovered. We have experienced a V shape recovery where 90% of the jobs that disappeared have now been reinstated and 97% of mortgages that were put on hold last year are now being repaid.

- This has led to significant increases in both consumer and business confidence.

- Historically low interest rates making borrowing as cheap as it has ever been and therefore holding investments or taking out a home loan very affordable

- The RBA “promised” not to raise rates for at least 3 years, saying it will do everything it can to support jobs, businesses and boost our economic recovery.

- The Senate is debating sweeping changes to remove overly restrictive lending rules. This will give more people access to easier credit, enabling them to borrow more and get into the market.

- Federal Government spending, initiatives, and infrastructure projects

- State Government spending and infrastructure initiatives

But, as I have explained, there are multiple housing markets within Brisbane, based on price point, geography and type of property and as always, you can’t just buy any property and count on the general Brisbane property market to do the heavy lifting over the next few years, so careful property selection will be critical.

Article Source: propertyupdate.com.au

from Queensland Property Investor https://ift.tt/3bWarAG

via IFTTT