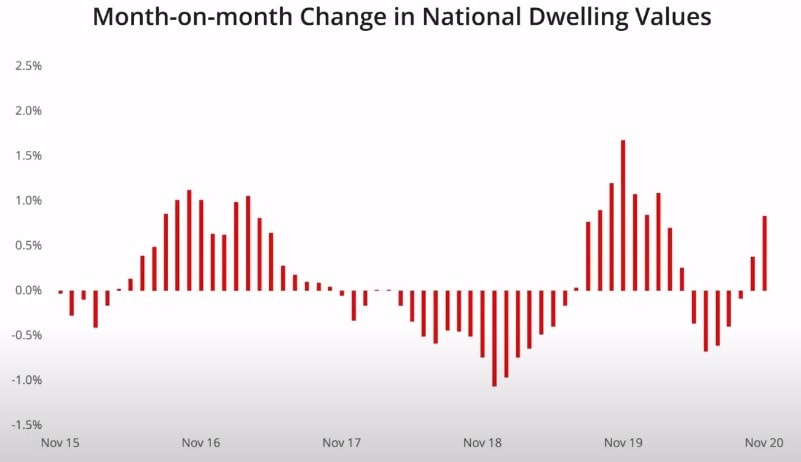

Australia’s housing market continued along a recovery trend through November, with our national home value index recording a second consecutive monthly rise.

With dwelling values up 0.8% over the month, the new recovery trend follows a 2.1% drop in Australian home values between April and September.

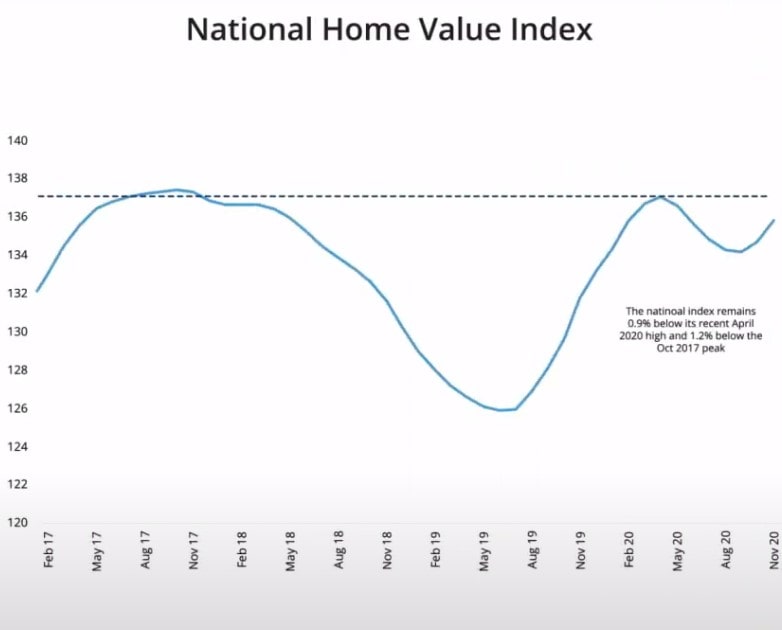

At this rate of appreciation, we are likely to see CoreLogic’s national home value index surpass pre-COVID levels in early 2021.

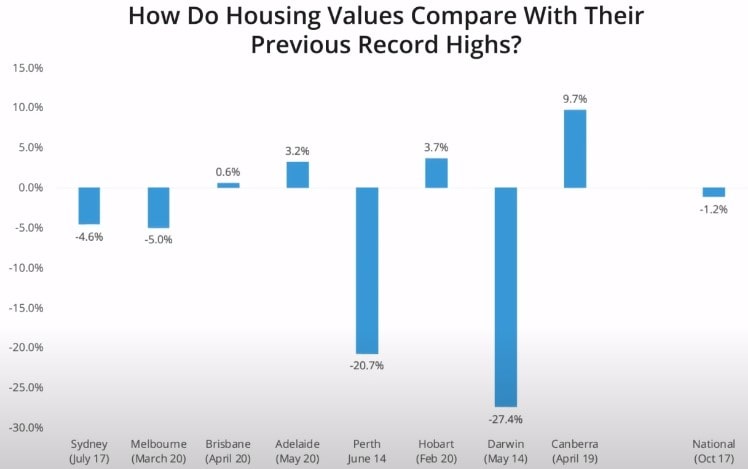

Although housing values look set to surpass their pre-COVID highs early next year, both Sydney and Melbourne home values remain at levels similar to those seen in early 2017.

While rising, Perth values are similar to levels in 2006, and Darwin values are in line with 2007 levels.

At the other end of the spectrum, housing values moved to new record highs in Brisbane, in Adelaide, Hobart, and Canberra through November.

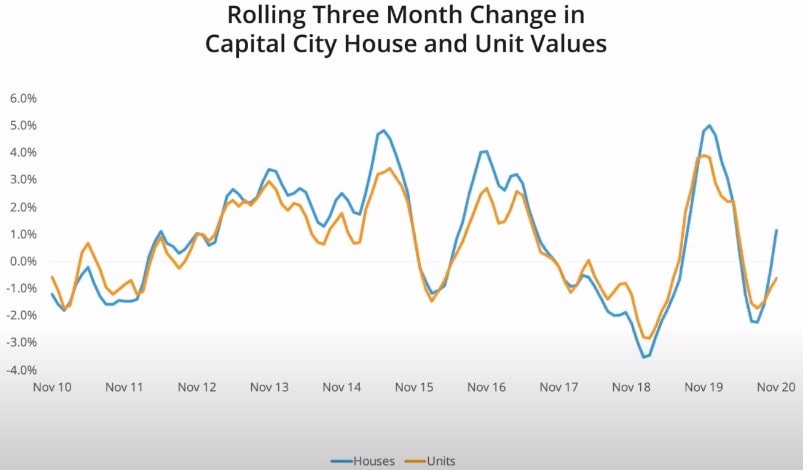

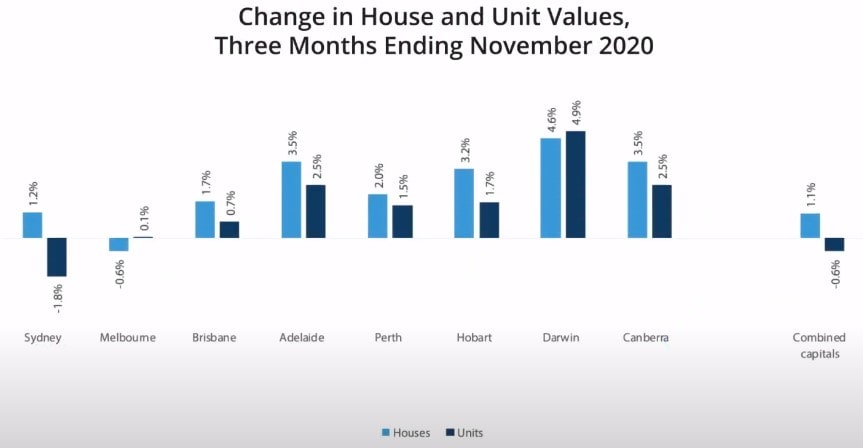

House and unit values have diverged over recent months.

the resilience in Melbourne unit values is surprising given the high supply levels across inner-city areas and the sharp decline in rental conditions.

We suspect the stronger trend in Melbourne unit values relative to houses could be short-lived unless overseas migration turns around sooner than expected which would help to shore up rental tenancy demand.

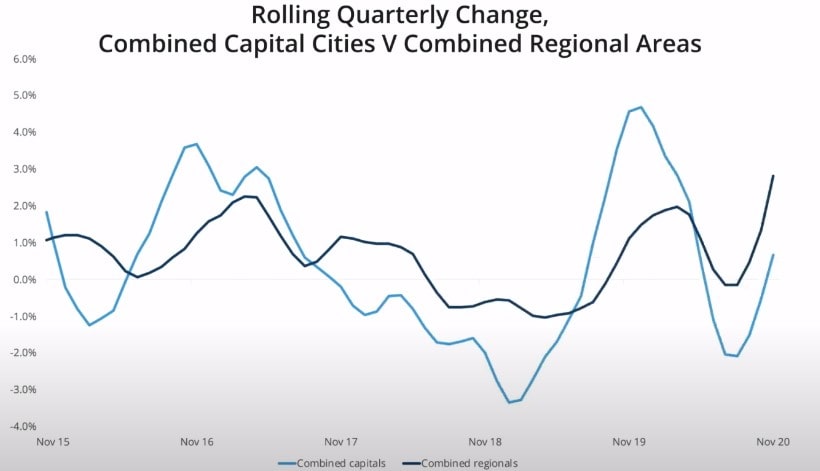

The stronger performance across the regional areas of Australia continued in November, with CoreLogic’s combined regionals index recording a monthly growth rate double that of the combined capitals.

Regional home values were up by 1.4% in November compared with a 0.7% rise in capital city values.

Regional Queensland has led the rise in values over the past three months, posting a 3.2% lift, followed be regional NSW where values are 3.1% higher.

Regional housing demand is being supported by a range of factors including the normalization of more flexible working arrangements across some occupations, as well as lifestyle factors, lower housing prices, and improved transport options.

With many employers now embarking on a ‘return to office’ program and the price gap between the capitals and regional markets narrowing, this trend could gradually start to lose momentum, but we are expecting the regional lifestyle markets to remain in high demand for some time yet.

The lift in housing values comes as a range of other indicators points to further improvement.

Inventory levels remain low across Australia at a time when demand is rising, leading to a market that is favoring sellers over buyers.

The number of properties advertised for sale remains 20% lower than this time last year, and 24% below the five-year average.

Total listing numbers are low despite a sharp rise in fresh being added to the market.

The spring period saw a 42% rise in the number of new listings added to the marketplace nationally, while the total number of listings dipped 0.6%.

This reflects a strong rate of absorption as prospective buyers continue to outnumber newly advertised supply additions.

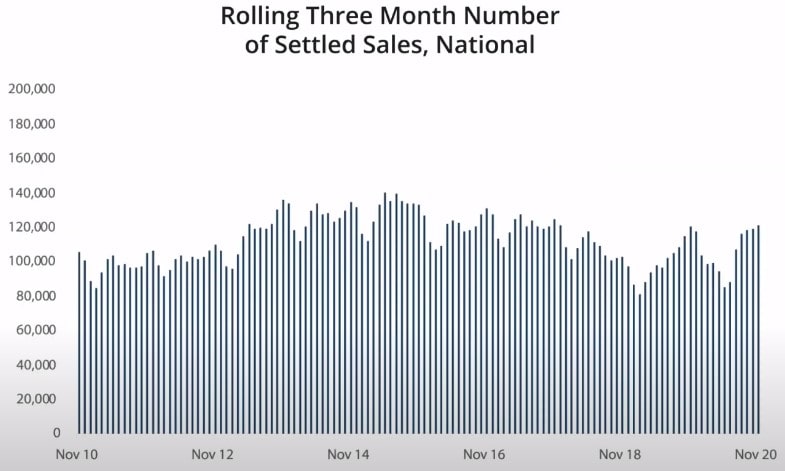

The number of settled sales has held reasonably firm since July, with rising sales activity outside of Victoria offsetting the sharp drop in Victorian home sales caused by the recent lockdown period.

Nationally, CoreLogic’s settled sales estimates over the past three months were about 1% higher than the same period last year.

This is partially due to the stronger demand across regional areas where buyer activity has seen a more significant lift than their capital city counterparts.

Auction markets have strengthened as well, with November clearance rates holding around the 70% mark, that’s well above the decade average of 61%.

The strength in the auction clearance rate comes as the number of auctions rises into the first half of December.

Higher auction volumes will provide a timely test of the market depth prior to the seasonal slowdown through late December and January.

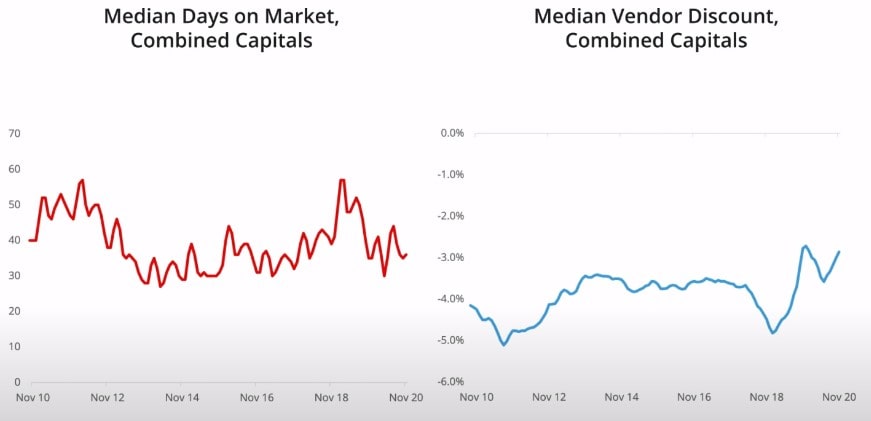

Private treaty measures are also tightening.

The median selling time reduced from 57 days in June to 42 days in November and discounting rates have reduced from 3.9% in April to 2.8% in November.

Article Source: propertyupdate.com.au

from Queensland Property Investor https://ift.tt/3n5X9F3

via IFTTT