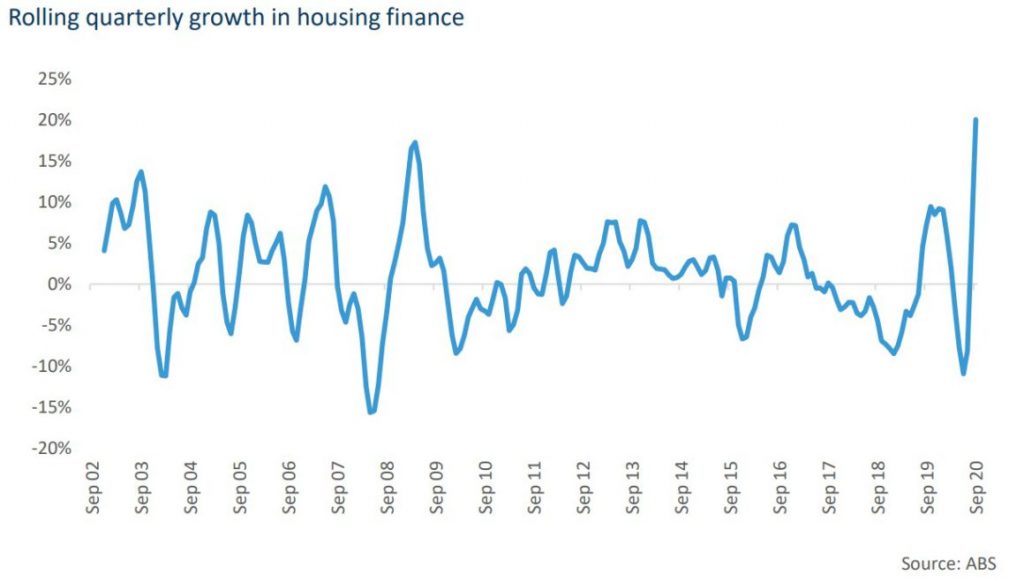

The volume trends of finance secured for the purchase of property experienced a strong rebound in the September quarter, following the initial shock to demand housing in the first two months of the June quarter.

The latest ABS housing finance data shows the volume of finance lent for the purchase of property increased 5.9% in the month of September, taking the quarterly increase to 20.0%, the highest quarterly growth rate on record.

It follows a 10.9% contraction in housing finance through the June quarter, when strict social distancing restrictions, such as a ban on open home inspections and on-site auctions, resulted in a sharp drop in transactions.

Housing finance for the purchase of property totaled $62.7 billion in the September quarter.

This is the highest level since the March 2018 quarter and is just 6.6% below the peak of the lending series in the three months to May 2017.

The uptick is a result of eased social distancing restrictions across the country, which have coincided with historically accommodative monetary policy, which sees mortgage rates at a record low.

As with the strong bounce-back in many economic indicators over the September quarter, eased social distancing led to a rise in consumer sentiment and an increase in sales and listings volumes. CoreLogic estimates that sales volumes increased around 27.7% in the quarter, despite renewed restrictions across Victoria.

The CoreLogic Residential Mortgage index (RMI) indicates further increases in housing finance over October and November.

The RMI tracks changes in valuation activity across CoreLogic platforms for the purpose of dwelling purchases.

In the 28 days ending 8th of November, the CoreLogic RMI rose 26.9%.

As can be seen in the chart below, the RMI is a leading indicator of monthly ABS housing finance commitments in the owner-occupier segment.

Queensland leads growth in housing finance

Of the states and territories, Queensland accounted for most of the increase in lending for the purchase of property.

The value of housing finance commitments (excluding refinancing) increased 40.2% in Queensland over the September quarter, accounting for around 31% of the uplift in finance nationally.

This was followed by NSW, which contributed 30% to the uplift nationally, as the state saw a 16.7% increase.

Western Australia had the largest increase in housing finance for the purchase of property over the September quarter, rising over 55%.

This further supports the view that the WA and Perth dwelling markets are resuming an upswing following the disruption of COVID-19.

The post “Trends in housing finance show the continued rise of owner occupiers and first home buyers, led by Queensland” by Eliza Owen appeared first on the propertyupdate.com.au Blog

from Queensland Property Investor https://ift.tt/2ICusR2

via IFTTT