The Sunshine Coast was one of the strongest regional housing markets in Queensland over the last 12 months, the Q3 Regional Report from property data firm CoreLogic has found.

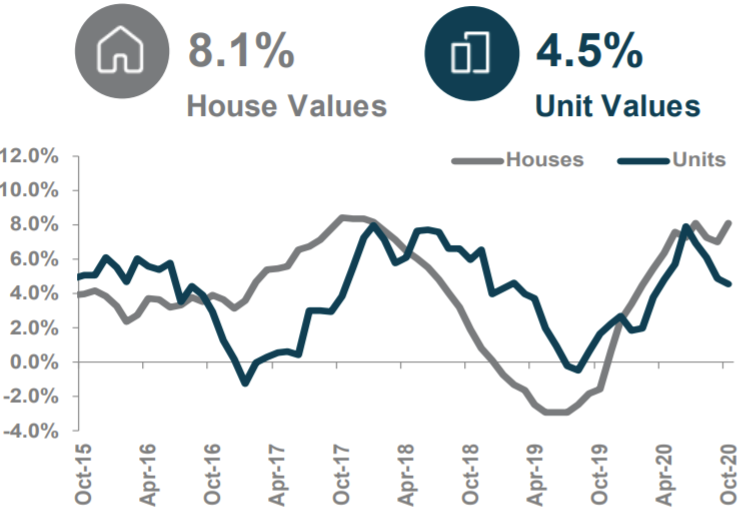

House values were up 8.1 per cent over the year to October.

They were driven by houses in the upper quartile, whose values were up 9.2 per cent compared to the lower quartile’s 7.4 per cent gains.

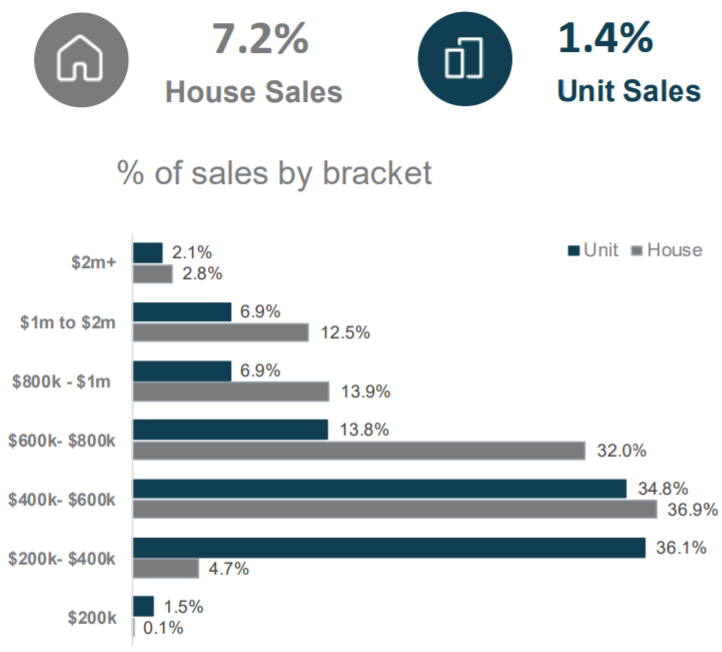

The number of house sales were up 8.1 per cent over the last 12 months compared to the 12 months prior. That spike was primarily driven by sales in the $200,000 to $400,000 bracket, which up 36.1 per cent.

Unit sales were slightly up for the region, just 1.4 per cent, driven by the $400,000 to $600,000 market which saw a 36.9 per cent sales spike.

Unit values saw an large increase, up 4.5 per cent.

It was the upper quartile that vastly outperformed the lower quartile for apartments, up 6.1 per cent compared to 2.5 per cent for the lower quartile.

The time on market for houses in now 47 days, compared to 53 days last year.

Units are also getting snapped up at a similar pace to 12 months ago, now at 50 days down from 61.

CoreLogic’s head of Australian research Eliza Owen said the traditional draw cards for regional dwelling markets such as lower density levels and lower purchase prices, coupled with the normalisation of working from home, have sparked increased interest among researchers.

“The results of this report support increasing levels of demand outside of cities. Regional Australia’s dwelling markets had higher rates of growth relative to capital cities through the pandemic,” Owen said.

“In the year to October, combined regional Australian dwelling markets rose 4.8 per cent, compared with a 3.9 per cent lift in the capital cities.

“Migration numbers from the ABS show net internal migration to the regions rose to a record high in the June quarter. This was because movements to regional Australia increased, while departures from the regions slowed. As a result, demand for dwellings in regional Australia will have risen at a time when the stock available for sale is relatively low.

“‘Commutable’ regional areas within a reasonable travel distance to the major metropolitan centres have seen particularly extraordinary increases in demand. House sales volumes increased by double digits across the mid north coast, Illawarra and the Hunter Valley.

“Of the 50 house and unit markets analysed, only six markets continued to show declines over the year, including markets far from metropolitans such as Riverina houses, Cairns units and units in Central Queensland.

“With record low mortgage rates and confidence returning to the Australian economy, there is likely to be a broader-based upswing across both regional and capital city markets into the first quarter of 2021,” said Ms Owen.

However, while the story seems largely positive for regional Australia’s residential property market, there is a downside.

“For local first home buyers, declining affordability may become a problem. Growth may start to slow in regions that have already seen a sustained upswing, due to such affordability constraints. These include areas such as Illawarra, Newcastle and Lake Macquarie, the Gold Coast and the Sunshine Coast, where annual growth rates in houses have already exceeded 7 per cent in the year to October,” concluded Ms Owen.

Article Source: propertyobserver.com.au

from Queensland Property Investor https://ift.tt/33kSirS

via IFTTT