There will be no huge spike in office market values in the post-COVID world.

That’s the view of NAB’s Q3 Commercial Property survey, which is forecasting declines to 2022.

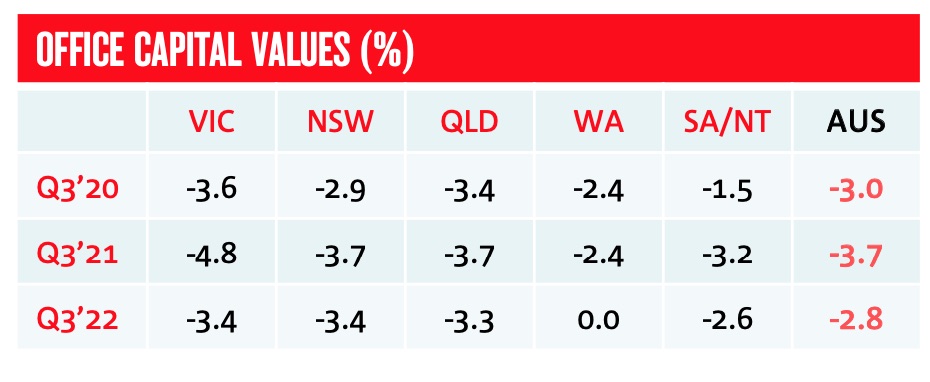

There’s only good news for Western Australia in the near term, whose values are forecast to decline -2.4 per cent in the next 12 months.

Then they expect the market to be flat to Q3 22.

Nationally, NAB expect capital growth in the office market to contract -3 per cent in the next 12 months, driven by VIC (-3.6 per cent), QLD (-3.4 per cent) and NSW (-2.9 per cent).

The SA and NT office market are forecast to fair slightly better over the next year, with declines of -3.2 per cent forecast.

“Property professionals see Office markets remaining “somewhat” over-supplied over the next 1-5 years in all states bar NSW (“neutral” in 5 years),” the reported read.

“The 12-month confidence measure was weakest for Retail (-71) property, followed by Office (-63), with confidence levels in both sectors little changed from the record low levels reported in Q2.”

“The 2-year measure was also broadly unchanged at near record lows in both sectors (Retail -47; Office -40).”

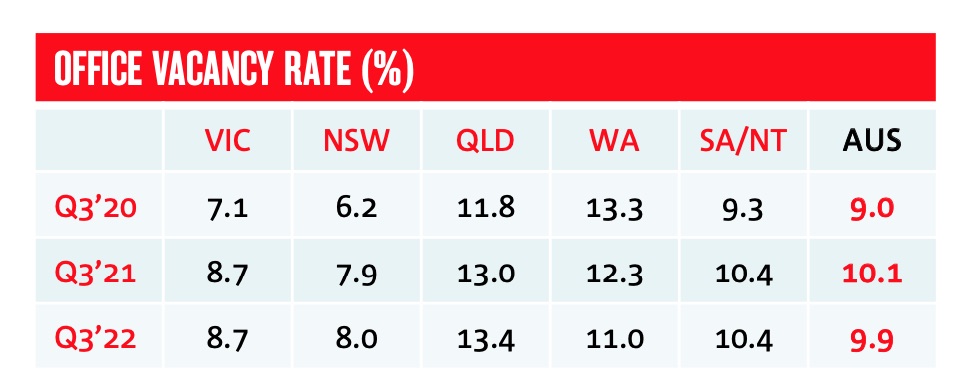

The national office vacancy rate lifted to a two and a half year high of nine per cent in Q3, up from 8.5 per cent in Q2, primarily driven by an increase in QLD (11.8%).

Overall vacancy is expected to climb further to around 10% in the next 1-2 years, with increases in VIC (around 8.7%), NSW (around 8%) and QLD (around 131⁄2%).

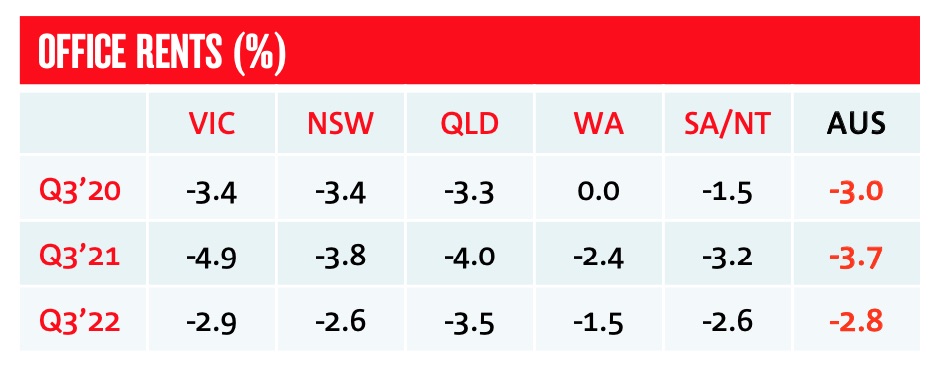

Over the next 12 months, rents are expected to fall -3% in office.

Rental growth is expected to continue falling in over the next 1-2 years, and in all states, with VIC (next 12 months at -4.9%) and QLD and SA/NT (in 2 years at -3.5%) under most pressure in office markets.

Article Source: propertyobserver.com.au

from Queensland Property Investor https://ift.tt/3lhUaYp

via IFTTT