Some 95,000 ANZ customers were accessing the bank’s COVID-19 assistance after experiencing financial difficulty due to COVID-19.

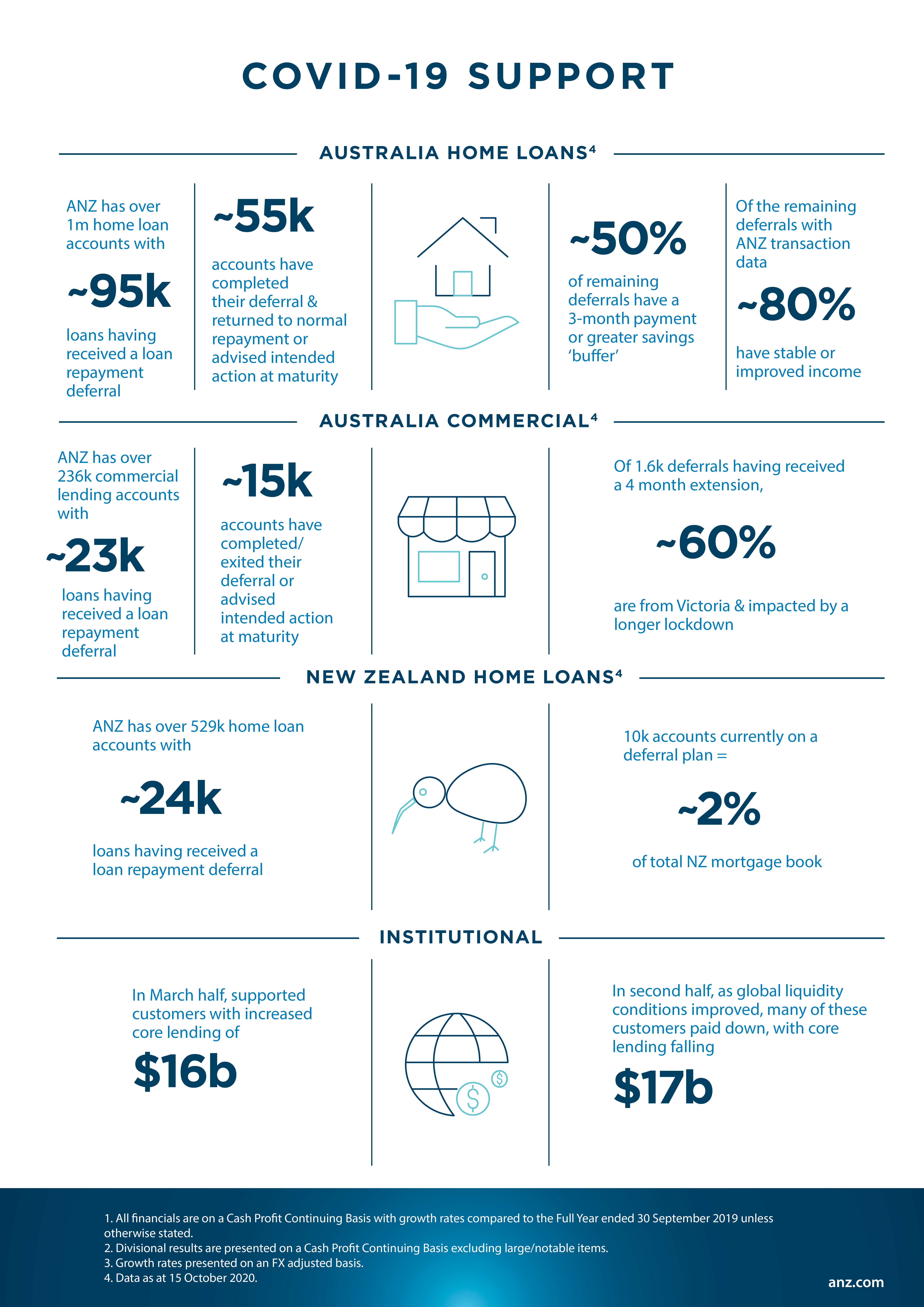

The bank said it had deferred home loans repayments for around 95,000 out of more than 1 million mortgages during the pandemic.

ANZ said there were 55,000 accounts where six month deferrals had been completed as at October 15.

Some 79 per cent are returning to full payment, 20 per cent had requested a further deferral, and 1 per cent have restructured their loan or sought additional support.

More than half of those home loan borrowers have either ended their deferral arrangements or advised ANZ what they intend to do when the loan repayment holiday ends.

“I would like to acknowledge the terrific work of our 39,000 people who have done a great job for our customers and shareholders in very difficult circumstances despite competing priorities over this extended period,” the ANZ boss Shayne Elliott said.

ANZ also took a look at the credit transactions in its customers’ accounts, and advised 80 per cent have “stable or improved income”.

The revelation came as ANZ reported its full-year net profit dropped 40 per cent to $3.58 billion in the 2019-20 financial year.

ANZ still plans to pay shareholders a final dividend of 35 cents per share.

The ANZ website advised customers may be able to put your home loan repayments on hold for up to six months (but interest will continue to be charged on your loan during this period). You will not be required to make any repayments to your home loan during the assistance period.

During the assistance period when repayments are on hold, interest will continue to be charged on your home loan and will need to be paid back over your remaining loan term.

This is known as interest capitalisation.

The total loan amount owed therefore increases when repayments are on hold during the assistance period.

It also revealed ANZ has more than 236,000 commercial lending accounts in Australia with around 23,000 having received a deferral on their business loan repayments.

As at 15 October, 15,000 business loan accounts have completed their deferral or advised their intended action at maturity.

Of these deferrals 1,600 have received a four month extension with 60 percent of those being from Victoria and impacted by the longer lockdown.

On customer sentiment, speaking to bluenotes via video-link from the bank’s Melbourne headquarters with its group executive Australia retail & commercial Mark Hand said although Australia’s economy is recovering well from the COVID-19 crisis, “customers are still feeling anxious about the future.”

“[Australia has had] many years of economic growth. So it’s been a long time since our customers have seen anything like a recession,” he says. “It’s important in times like this [for] customers to ask questions, to go back to their trusted advisors.”

“Take a breath, have conversations with people that have been through this scenario. Talk to your banker and really think about how you want to manage for the next six or so months.”

In New Zealand ANZ has more than 529,000 home loan accounts in New Zealand with around 24,000 having received a deferral on their loan repayments. As at 15 October, there are 10,000 accounts in NZ currently on a deferral plan, representing 2% of the total New Zealand mortgage book.

This article is republished from propertyobserver.com under a Creative Commons license. Read the original article.

from Queensland Property Investor https://ift.tt/34CZpNa

via IFTTT