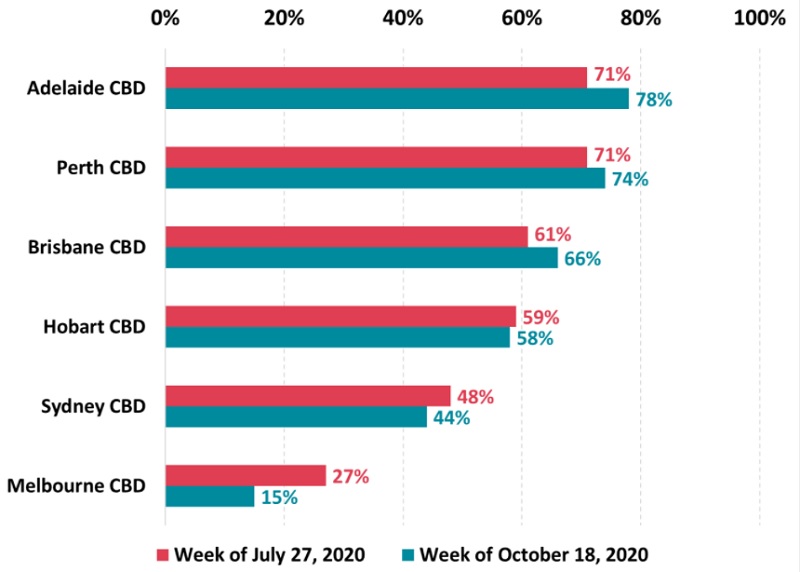

Australian cities are lacking life with the number of people moving around city centres barely changing from late July and remain well below pre-pandemic levels.

Conditions in Melbourne and Sydney are getting worse while other cities have shown little improvement according to Roy Morgan and UberMedia.

The analysis tracked mobile location data of people visiting the CBD, excluding residents, comparing results between late January, the week of 27 July and 18 October.

Movement in Adelaide CBD is closest to pre-Covid levels at an average of 78 per cent, ahead of Perth at 74 per cent.

Meanwhile in places where large outbreaks have occurred city activity has dropped further since the middle of the year with Melbourne falling from 27 per cent to 15 per cent and Sydney from 48 per cent to 44 per cent.

Activity in Brisbane has picked up 5 per cent from the middle of the year but still sits at 66 per cent below pre-pandemic levels.

Impact of Covid on city centre movement

^Source: Roy Morgan, UberMedia; percentage compared to January-February data

This level of activity in city centres is a concern for major landlords with retail rent expected to drop 20 per cent and office market rent under pressure until employees return to the workplace.

Roy Morgan chief executive Michele Levine said the analysis shows that a pre-vaccine Covid-normal is very different to conditions seen earlier in the year.

“In cities including Adelaide and Perth there has been little to no local transmission of the virus for months—not since late April for Perth and not since early May for Adelaide—more than five months ago,” Levine said.

“Both have increased slightly since late July but remain well below the levels that hospitality and retail businesses in the city centres are accustomed to.”

Activity in Melbourne is expected to pick up following the end of heavy lockdowns.

“The staged re-opening of retail and hospitality businesses in Melbourne this week is a step in the right direction but city office workers are still being encouraged to work from home for the foreseeable future and mask wearing remains mandatory in the Victorian capital,” Levine said.

“The movement data for the Melbourne CBD is set to increase substantially in the next few weeks and retailers and traders in the city will be closely watching to see how quickly Melbourne can close the gap on interstate counterparts such as Sydney or Brisbane.”

This article is republished from theurbandeveloper.com under a Creative Commons license. Read the original article.

from Queensland Property Investor https://ift.tt/3jA2guE

via IFTTT