The Reserve Bank is closely monitoring residential rental properties as the pandemic-induced economic downturn continues to disproportionately affect renters, a recent report reveals.

According to the bank, rental price growth will remain subdued through 2021 as restrictions on international migration continues to lift vacancies.

According to a recent ANZ CoreLogic housing affordability report, advertised rents have declined sharply since the onset of the pandemic, especially within Sydney and Melbourne’s inner-city apartment markets, while vacancies have surged more than fivefold in the Melbourne CBD and quadrupled in Sydney.

The RBA noted inner-city dwellings were usually occupied by the people who had experienced the greatest financial impact from the virus-induced economic downturn, such as workers in the hospitality and tourism sector.

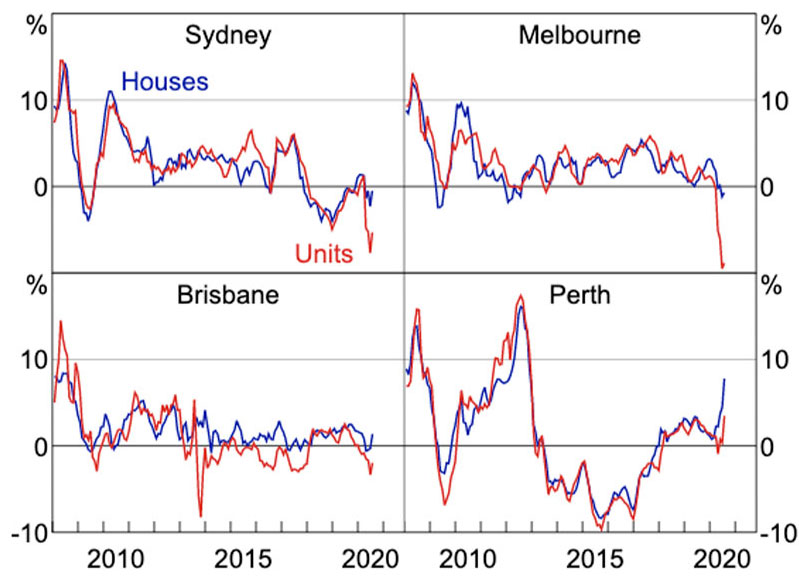

Advertised rental growth

^Source: Corelogic, RBA — three month ended annualised, seasonally adjusted

To date, government policies to support renters and landlords, such as moratoriums on evictions, land tax discounts and income support measures such as Job Seeker attempted to shield the market from much more pronounced impacts.

Since the outbreak, close to 15 per cent of tenants with existing residential leases have received some relief, according to data from property management platform MRI.

Competition for tenants has further intensified as short-stay landlords continue to switch properties into the long-term rental market to find longer-term tenants.

On Airbnb alone, listings declined by around 20 per cent, or 40,000 properties, between February and May.

RBA economist Richard Evans said rents in inner-city areas over the next few years will likely remain lower than expected pre-pandemic given lower population growth and the anticipated supply of apartments in these markets.

“In the near term, the successful suppression of Covid-19 and the controlled reopening of international borders in 2021 would result in increased rental demand in inner Sydney and Melbourne, reducing vacancy rates and supporting rents,” Evans said.

“Alternatively, setbacks in controlling the virus in Australia and internationally may delay the reopening of international borders, prolonging the loss of demand from international tourists and students pushing domestic demand for inner-city rentals lower.”

The Reserve Bank said the continued decline in population growth would likely result in a decline in rents of around 3 per cent nationally over the coming years.

Since March, vacancy rates increased by around 2 percentage points in the inner regions of Sydney and Melbourne and a little more than 1 percentage point in the outer suburbs of Sydney, but were broadly unchanged in regional Victoria.

In Brisbane, vacancy rate increases were most pronounced in the inner suburbs, where vacancies increased by a little over 1 percentage point in the June quarter.

In contrast, Perth’s rental market vacancy rates fell by 1.6 per cent over the period, largely driven by a lack of new housing.

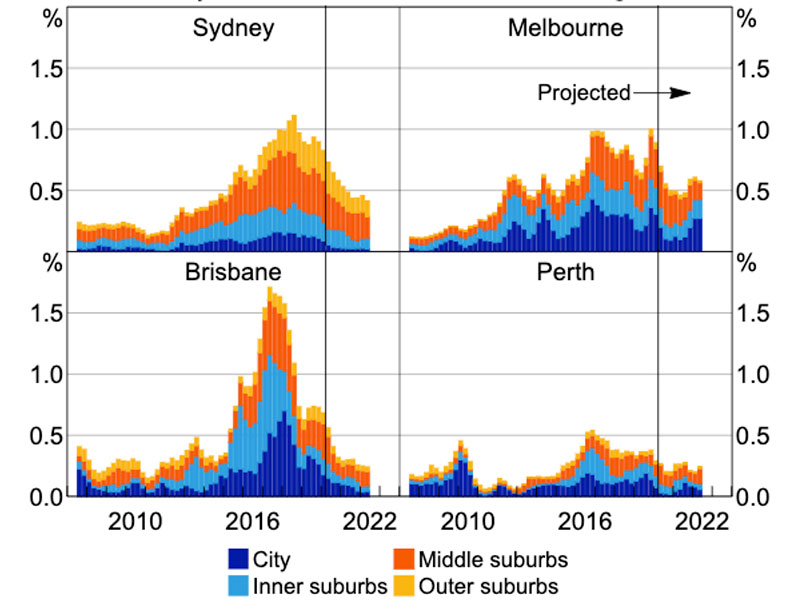

Apartment completions

^Source: ABS, RBA — estimated using building approvals

Longer-term rental supply on the horizon

In Sydney and Melbourne, the number of apartments estimated to be completed over the next two years is equivalent to around 4 per cent of the non-detached dwelling stock, the RBA said.

In Melbourne, over half of the pipeline of apartments yet to be completed is located in the city and inner suburbs, compared to around one-quarter in Sydney.

“Over the medium term, the pipeline of apartments due to be completed, combined with weaker population growth, is expected to see the national vacancy rate increase by around 1 percentage point by 2021,” RBA economist Tom Rosewall said.

“We then expect the national vacancy rate to decline slowly as supply adjusts and international borders reopen.”

Developers are now eyeing the build-to-rent sector as a potential alternate asset class, driver by an appetite for stable, consistent returns.

According to a recent report by CBRE, more than 30 major build-to-rent (BTR) projects with an average size of 365 apartments totalling 11,667, have been confirmed over the last 12 months.

An additional pipeline estimated at more than 10,000 units are currently in due diligence with further announcements expected later in the year and beyond.

This article is republished from https://theurbandeveloper.com/ under a Creative Commons license. Read the original article.

from Queensland Property Investor https://ift.tt/3ckSoms

via IFTTT